Financial stress is a common problem affecting millions worldwide. The pressure of managing finances can feel overwhelming, Whether due to unexpected expenses, job loss, or mounting debt. However, effective strategies backed by facts and expert recommendations can help you regain control and reduce stress.

This article explores how to deal with financial stress, providing actionable solutions and insights to rebuild stability and peace of mind.

1. The Impact of Financial Stress

Financial stress doesn’t just affect your wallet—it impacts your mental and physical health. Studies published in The Journal of Financial Therapy reveal that chronic financial stress can lead to anxiety, depression, and even physical ailments like high blood pressure. Recognizing its impact is the first step toward addressing the issue.

2. Analyze Your Financial Situation

Facing financial problems begins with understanding your current financial standing. This step involves:

- Tracking Income and Expenses: Use free tools like Mint or YNAB to categorize expenses and identify areas of overspending.

- Reviewing Debts: List all debts, their interest rates, and payment schedules to prioritize repayment effectively.

According to a survey by the National Foundation for Credit Counseling (NFCC), 62% of Americans do not maintain a budget, which is a leading cause of financial stress.

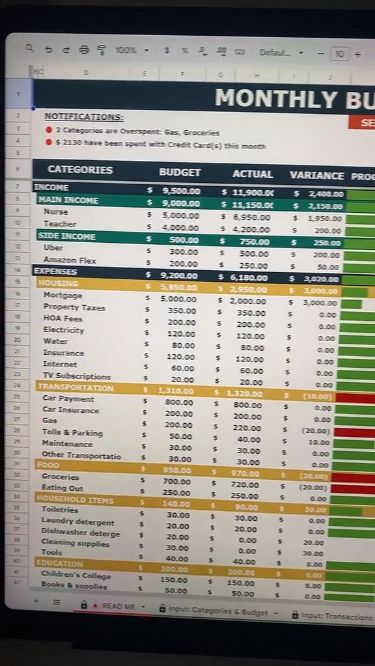

3. Create a Practical Budget

A realistic budget can alleviate financial anxiety by giving you control over your money. Follow these steps:

- Prioritize Essentials: Focus on needs like housing, food, and transportation.

- Cut Non-Essentials: Eliminate discretionary spending such as dining out or streaming subscriptions until your financial situation improves.

- Allocate for Savings: Even if it’s a small amount, saving provides a safety net and reduces future stress.

Pro Tip: The 50/30/20 Rule—allocate 50% of income to necessities, 30% to wants, and 20% to savings and debt repayment—can guide your budgeting process.

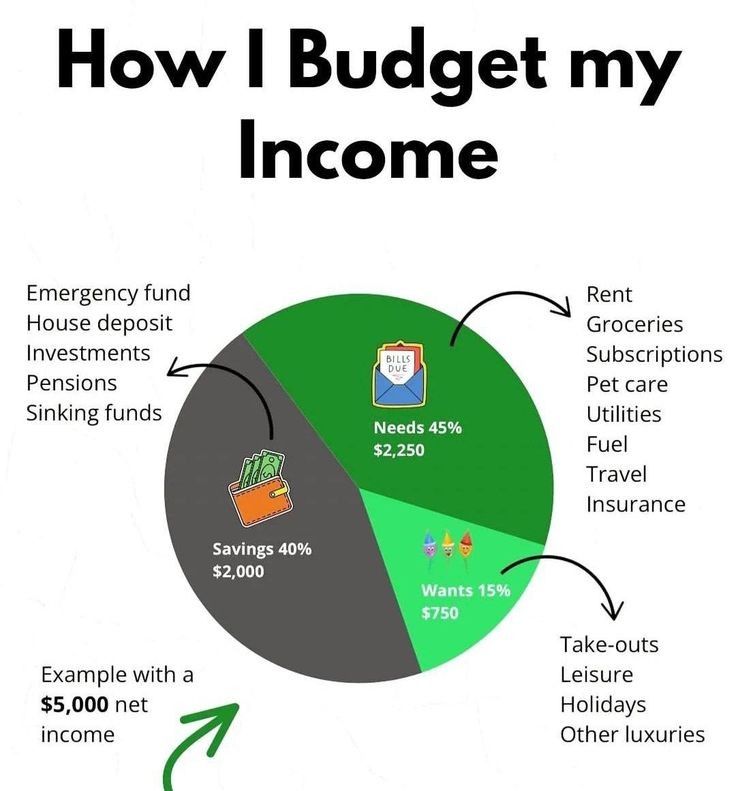

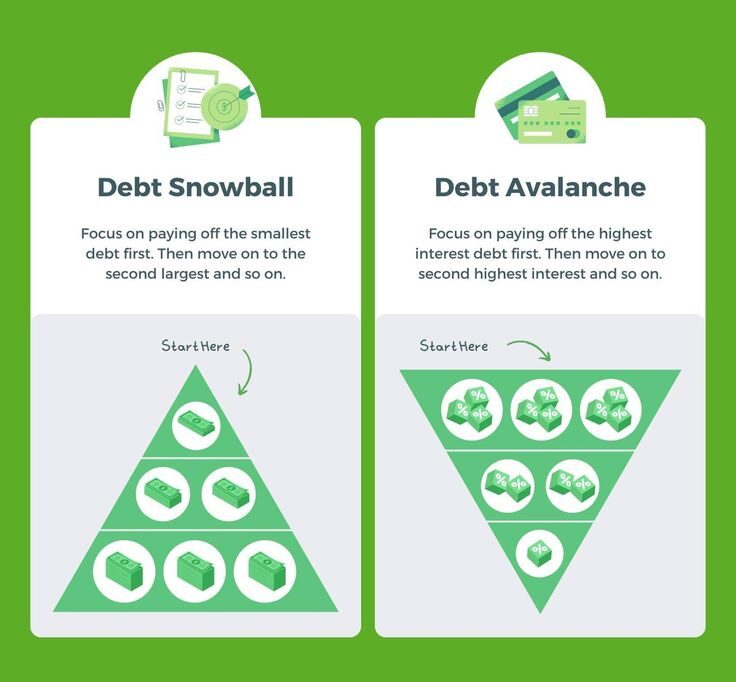

4. Address Debt Strategically

Debt is a significant contributor to financial stress, but you can manage it using proven strategies:

Debt Snowball Method: Pay off smaller debts first to build momentum.

Debt Avalanche Method: Focus on high-interest debts to save money over time.

Negotiate with Creditors: Many creditors offer hardship programs or reduced payment plans if you communicate early.

A study by the American Psychological Association found that reducing high-interest debt reduces stress levels significantly over time.

5. Increase Income with Side Hustles

Sometimes, cutting expenses isn’t enough. Consider boosting your income with flexible side jobs

Freelancing: Use platforms like Upwork or Fiverr to offer services in writing, graphic design, or coding.

Selling Online: Platforms like eBay and Facebook Marketplace allow you to sell unused items.

Gig Work: Drive for Uber or deliver food via DoorDash to earn quick cash.

A Pew Research study highlighted that 36% of Americans have taken on side gigs to manage financial strain.

6. Build an Emergency Fund

An emergency fund is essential for reducing future financial stress. Start small:

- Set aside just $5-$10 weekly in a separate account.

- Use automatic transfers to ensure consistent savings.

A Bankrate survey found that 56% of Americans cannot cover a $1,000 emergency expense, underscoring the need for an emergency fund.Learn more about emergency fund strategies at NerdWallet.

7. Use Free Resources and Support

When money is tight, explore free community resources:

- Food Pantries: Access free groceries from local food banks.

- Nonprofits and Charities: Organizations like the Salvation Army provide rent and utility assistance.

- Government Programs: Apply for benefits like SNAP or Medicaid to reduce financial burdens.

Websites like Benefits.gov can help you find federal and state aid programs you qualify for.

8. Prioritize Mental and Physical Health

Financial stress can spiral into poor mental health if not managed:

- Exercise: Physical activity reduces stress hormones like cortisol.

- Meditation: Apps like Headspace provide free guided meditation for stress relief.

- Counseling: Seek financial therapists who specialize in addressing money-related anxiety.

The American Institute of Stress reports that 73% of people rank finances as their number one source of stress.

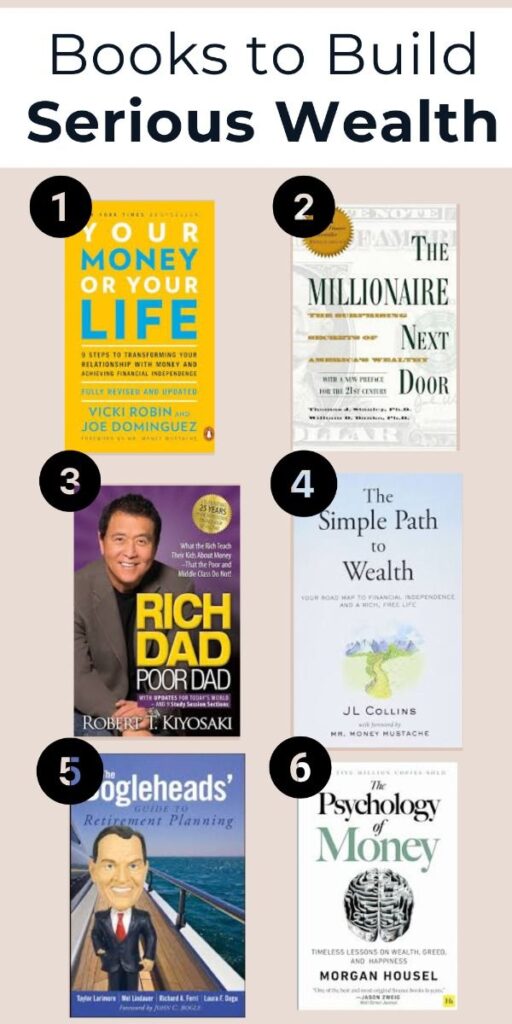

9. Strengthen Financial Literacy

Knowledge is a powerful tool against financial stress. Learn basic money management skills:

Budgeting Techniques: Read books like The Total Money Makeover by Dave Ramsey.

Investing Basics: Explore free online courses from Coursera or Khan Academy.

Debt Management: Educate yourself on repayment strategies to regain control.

A FINRA study found that individuals with higher financial literacy are significantly less likely to experience severe financial stress.

10. Focus on Long-Term Financial Goals

Set achievable financial goals to maintain motivation:

- Short-Term: Save $100 in 30 days or pay off one small bill.

- Medium-Term: Build a $1,000 emergency fund.

- Long-Term: Plan for retirement with contributions to savings accounts or IRAs.

Pro Tip: Use goal-tracking apps like PocketGuard to stay focused.

Conclusion

Financial stress can feel daunting, but solutions exist. By analyzing your situation, creating a budget, addressing debt strategically, and leveraging free resources, you can regain control of your finances. Remember, how to deal with financial stress is not about quick fixes but consistent, actionable steps that lead to long-term stability.

By implementing these evidence-backed strategies, you not only manage financial stress but also build a resilient foundation for future success. Start small, stay committed, and take control of your financial journey.